Car depreciation calculator excel

The first step is to enter the numbers and their corresponding headings in the appropriate cells. Here D4 is the annual interest rate D5 is the number of years D6 is the number of payments per year and D7 is the original price of the car.

Download Depreciation Calculator Excel Template Exceldatapro

To calculate the depreciation of your car you can use two different types of formulas.

. You can then calculate the depreciation at any stage. This new car will lose between 15 and 25 every year after the steep first-year dip. After choosing the method enter the cost amount of the financial asset.

To use a double-declining credit select the declining ratio and then raise the depreciation factor to 2. To put it in perspective brand new automobile costs around the same as that. By entering a few details such as price vehicle age and usage and time of your ownership we.

Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. Calculate Car Depreciation By Make and Model Find the depreciation of your car by selecting your make and model. Under this method annual depreciation is.

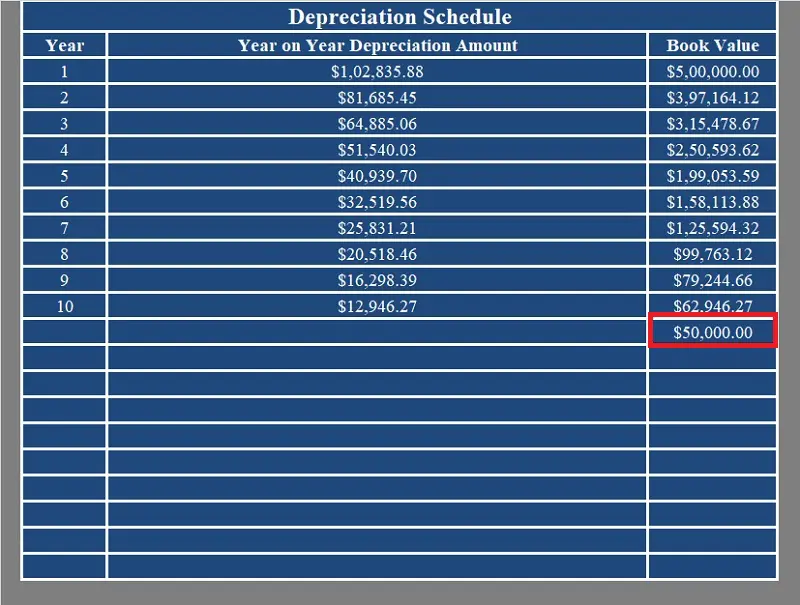

It will then depreciate another 15 to 25 each year until it reaches. Use this depreciation calculator to forecast the value loss for a new or used car. Sum-of-Years Digits is a depreciation method that results in a more accelerated write-off than straight line but less than declining-balance method.

For example to calculate the depreciation between the 2nd and 4th years of an asset with an initial cost of 20000 a useful life of 5 years and a salvage value of 4000 the. Prime Cost Method for Calculating Car Depreciation Cost of Running the Car x Days you owned 365 x. We will even custom tailor the results based upon just a few of.

10 Depreciation Calculator Templates in EXCEL car depreciation calculator straight line depreciation calculator vehicle depreciation calculator business vehicle depreciation. To calculate the depreciation value Excel has built-in functions. AFTER FIVE YEARS.

If the price is more than 25000 it appears like youve got a great deal. The car depreciation calculator will reflect the cars initial value in this case over 20500 if you enter the value into the 3 years box. Under the variable declining balance method depreciation rate to be applied to the opening carrying balance of an asset is worked out using the following formula.

B12 is the number of.

Depreciation Schedule Template For Straight Line And Declining Balance

Sales Price Estimate Template Download Excel Worksheet Estimate Template Estimate Templates

How To Prepare Depreciation Schedule In Excel Youtube

How To Use The Excel Db Function Exceljet

Expense Break Even Calculator Templates 12 Free Xlsx Pdf Resume Examples Good Essay Analysis

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

Depreciation Calculator

Free Depreciation Calculator In Excel Zervant

Depreciation Formula Calculate Depreciation Expense

Sales Lead Form Template Word Beautiful Sales Lead Template Word Excel Forms Template Service Word Find Agenda Template Templates

How To Prepare Depreciation Schedule In Excel Youtube

Download Depreciation Calculator Excel Template Exceldatapro

Home Office Expense Spreadsheet Spreadsheets Offered Us The Probable To Input Transform And Tax Deductions Free Business Card Templates Music Business Cards

Using Spreadsheets For Finance How To Calculate Depreciation

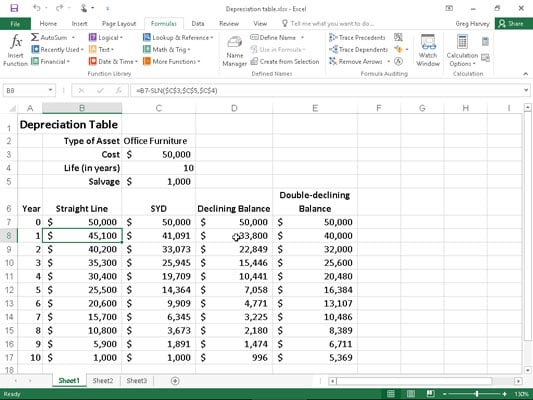

How To Use Depreciation Functions In Excel 2016 Dummies

Free Macrs Depreciation Calculator For Excel

Download Depreciation Calculator Excel Template Exceldatapro